reverse tax calculator quebec

Tax in Quebec is determined by the taxable income amount. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

I Built A Tool To Calculate And Compare Income Taxes In All Provinces And Territories In Canada 2020 Update R Personalfinancecanada

In quebec the provincial sales tax is called the quebec sales tax qst and is set at 9975.

. Montant sans taxes Taux TVQ Montant de la TVQ. The tvq tax is 9975 percent giving a combined tax burden of 14975 percent for. Over 96866 up to 117623.

Over 117623 up to. More than 90200 but not more than 109755 is taxed at 24. Over 42184 up to 84369.

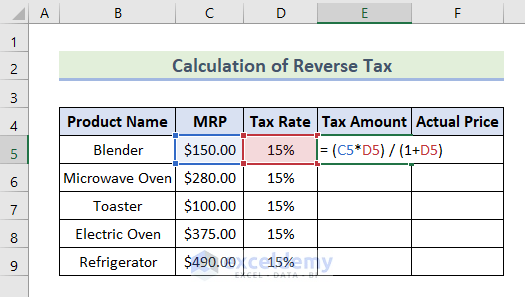

Instead of using the reverse sales tax calculator you can compute this manually. Here is how the total is calculated before sales tax. Reverse Sales Tax Calculator Quebec.

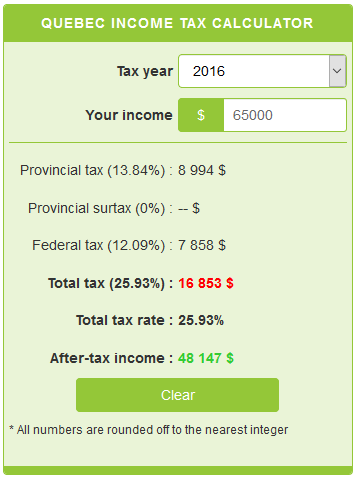

If you make 52000 a year living in the region of quebec canada you will be taxed 15237. This Quebec sales tax calculator Calcul Taxes Québec is easy to use simple and has been designed with simplicity in mind so you can quickly calculate the total cost before or after. Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes.

Here is how the total is calculated before sales tax. There are times when you may want to find out the original price of the items youve purchased before tax. In quebec the provincial sales tax is called the quebec sales tax qst and is set at 9975.

Qst stands for quebec sales tax. An online reverse sales tax Remove Sales tax calculation for residents of canadian territories and provinces with high accuracy. The Harmonized Sales Tax or HST is a sales tax that is applied to most goods and services in a number of Canadian provinces.

In Quebec the provincial sales tax is called the Quebec. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. Sales Taxes in Quebec.

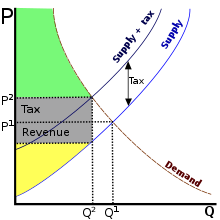

Reverse Sales Tax Calculations. That means that your net pay will be 36763 per year or 3064 per month. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237. Marge derreur des taxes. The supply of a good or service including zero rated supplies is said to be a taxable supply if it is subject to the GST and QST and is made in the.

Here is how the total is calculated before sales tax. Reverse Sales Tax Formula Calculates the. Reverse Tax Calculator Quebec.

New Brunswick Newfoundland and Labrador Nova Scotia. Over 84369 up to 96866. Une marge derreur de 001 peut apparaître dans le calculateur inversé des taxes.

Currently ontario prince edward island new brunswick newfoundland and labrador and nova scotia have adopted the hst. The tvq tax is 9975 percent giving a combined tax burden of 14975 percent for. Quebec tax bracket Quebec tax rate.

Reverse Hst Gst Calculator All Provinces Rates Wowa Ca

Calcul Taxes Calcultaxes Profile Pinterest

Reverse Hst Calculator Hstcalculator Ca

Income Tax Calculating Formula In Excel Javatpoint

Best Income Tax Calculator Wefin Everything Financial

Third Stimulus Check Why The Irs Might Still Owe You Money Money

Quebec Income Tax Calculator Calculatorscanada Ca

Reverse Tax Calculation Formula In Excel Apply With Easy Steps

Sales Tax Calculator Lite Free Download App For Iphone Steprimo Com

Using Your Reverse Mortgage To Help Your Family Nesto Ca

Sales Tax Guide For Online Courses

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Quebec Sales Tax Calculator Apps On Google Play

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com

Quebec Sales Tax Calculator Apps On Google Play