what is tax planning in india

It is one of the main problems faced in India. The objective behind tax planning is insurance of tax efficiency.

What Is Tax Planning Definition Objectives And Types Business Jargons

You can save tax and earn returns with the best tax saving schemes in India.

. A compulsory contribution to state revenue levied by the government on workers income and business profits or added to the cost of some goods services and transactions Pay attention to the words. One of the most important features of tax planning is that it is completely in-line with the legal and financial rules set by the Government of India. It helps in effective cash flow and liquidity management for taxpayers and better retirement plans and investment opportunities.

Tax planning is an activity that enables you to reduce your tax liability. However in the 401K plan. For successful corporate tax planning in India the corporation must be well aware of all the tax laws as well as the financial rules set up by the Government of India.

Income Tax Amendments in FY 2021-22. 187500 30 of total income exceeding 1500000. New tax regime slab rates are not differentiated based on age group.

Since Tax is kind of cast the reduction of cost shall increase the profitability. So if you think that you pay too many taxes and want to curtail them then you need to go for proper tax planning. Plan through post offices across India as well as through banks.

So it is advisable for investors to evaluate the different investment plans offered by the government before selecting the best. This will ensure you dont pay more taxes and save taxes in India along. Apart from the salary if the individuals have the income from any.

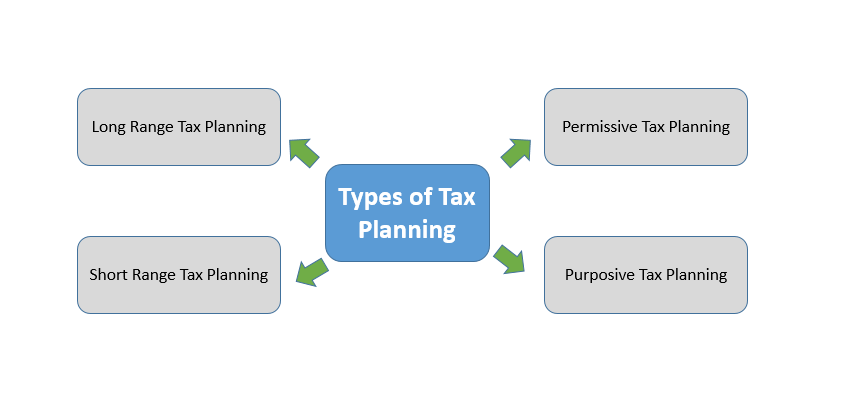

Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc. Income Tax Planning For Salaried Employees in India. Taxation in India - A tax is a compulsory fee that is levied by any government on an individual or an organization to collect revenue for public works.

Tax planning is a legal way of reducing income tax liabilities however caution has to be maintained to ensure that the taxpayer isnt knowingly indulging in tax evasion or tax avoidance. What is Tax Evasion in India. Tax planning is the process of analysing a financial plan or a situation from a tax perspective.

Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and benefits to minimize his tax liability each financial year. People evade tax through illegal and unfair means. These amendments and revisions once proposed are approved by the Parliament and implemented as lawv.

Whereas tax planning is a strategy to determine the amount of tax payable in such a way that the corporate has more net profit and less tax to pay legally. Corporate tax in India planning differs from non-payment or tax evasion. Tax planning is a focal part of financial planning.

Tax planning is the analysis of a financial situation or plan to ensure that all elements work together to allow you to pay the lowest taxes possible. Tax Planning - Importance and Benefits of Tax Planning. The ideal time to plan for tax saving investments is the beginning of the financial year.

In this new regime taxpayers have the Choice of either. As far as paying income tax it feels good because it is an indicator of prosperity and the taxpayer feels. However under old tax regime the basic income threshold exempt from tax for senior citizen aged 60 to 80 years and super senior citizens.

It is one of the most basic yet integral parts of the financial plan and it helps you save your capital. Taxes are undoubtedly great but they are a toll for those who have a lot of responsibilities. To know more about income tax read on.

Every prudence person to maximize the Return shall increase the profits by resorting to a tool known as a Tax Planning. Tax Planning is minimizing your tax liability by making the best use of all available deductions allowances rebates thresholds etc as permitted by income tax laws rules stipulated by the government of a country. However Income Tax in India is governed by numerous direct and indirect factors that can seem complex without a basic understanding.

The Oxford dictionary defines tax as. Know more about the types of taxes recent reforms income tax tax slabs and more. They get the tax refunded by making misrepresentation before the tax authorities.

In other words it is the analysis of a financial situation from the taxation point of view. There are numerous ways in which we can save our taxes. Financial Plan 360.

The objective of tax planning is to make sure there is tax efficiency. 1 day agoThus tax planning should start with the start of the financial year and we should declare in advance to our employer about the expenses and investment and should adhere to the commitment by providing evidence of such expenses and investment when required by the management. Tax Planning is resorted to maximize the cash inflow and minimize the cash outflow.

They may claim lesser profit gains or turnover than the actual. The interested individuals can opt for any govt. Tax planning allows a taxpayer to make the best use of the various tax exemptions deductions and benefits to minimize their tax liability over a financial year.

The use of tax payers is to guarantee tax effective. 2 days agoNew Delhi India March 6 ANI. Tax planning can be referred to the act of planning an individuals finances in such a way that the payable tax amount is reduced while the gains are maximized.

With the help of tax planning one can ensure that all elements of a financial plan can function together with maximum tax-efficiency. 262500 30 of total income exceeding 1500000. Tax planning is the logical analysis of a financial position from a tax perspective.

In India the employer contribution and the employee contribution to EPF is tax free in the hands of the employee. However this is not its sole objective. The primary concept of tax planning is to save money and mitigate ones tax burden.

It ensures savings on taxes while simultaneously conforming to the legal obligations and requirements of the Income Tax Act 1961. Tax evasion is defined as the illegal non-payment or under payment of tax by an individual. Tax planning is a significant component of a financial plan.

Most such government plans permit tax deductions and allow the investor to save money on income tax. Income tax slabs in India are amended and revised each year during the Central Governments Budget Session.

Tax Planning Services Tax Planning Services India Farsight Group How To Plan Tax Consulting Financial Analysis

Tax Planning How To Plan Tax Income Tax

Tax Planning Objectives Accounting Services Tax Guide Tax

Tax Planning In India With Types Objectives

If You Are In Need Of Professional International Tax Planning And Management Services Then Ashok Maheshwary And Associates I Make More Money Tax Services Firm

Tax Planning How To Plan Investing Budgeting Finances

Rise Above These Tax Planning Habits Plan Early Invest Smartly And You Will Surely Be On The Path To Optimise Your Tax Sav Investing How To Plan Optimization

Differences Between Tax Evasion Tax Avoidance And Tax Planning

All About Investment In Equity Shares Tax Planning

Difference Between Tax Planning And Tax Management With Table Ask Any Difference

Tax Planning Tax Saving Tax Management Tax Consultant

Tax Planning Is A Process Of Looking At Various Tax Options In Order To Determine When Whether And How To Conduct Business And Strategies Tax Return Business

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Planning Is Necessary For The Growth Of Business It Will Help In Minimising The Taxes And Improves The In Income Tax Preparation Investing Tax Preparation

Tax Planning When Did You Start Planning You Taxes Do You Know That Tax Planning Is An Integral P Personal Financial Planning Personal Finance Personal Goals

What Is Tax Planning Definition Objectives And Types Business Jargons

Best Tax Planning Tips For 2019 Nationlearns Personal Financial Planner Financial Advice Financial Advisory

Tax Planning Personal Financial Planner Investing Financial Fitness